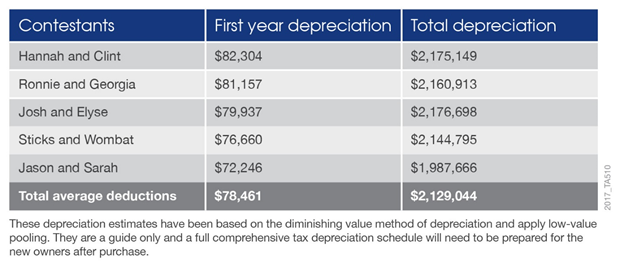

Analysis by Australia’s leading tax depreciation schedule provider suggests that investors could claim an average of around $2.1 million in depreciation deductions for each property on Channel 9’s 2017 season of The Block.

According to estimates provided by BMT Tax Depreciation, Hannah and Clint’s property has the highest amount of depreciation deductions available, with a first-year deduction estimated to be $82,304 and a total average deduction estimated to be $2,175,149 which can be claimed by the new owners.

Ronnie and Georgia’s property, 46c Regent Street, Elsternwick, has the second highest depreciation deductions with a total average deduction of $2,160,913 claimable over the lifetime of the property.

“Hannah and Clint’s property may prove attractive to savvy investors who are looking to capitalise by renting the property and claiming the additional deductions available from depreciation,” said Bradley Beer, the Chief Executive Officer of BMT Tax Depreciation.

“The property has a number of standout items such as designer Caesarstone kitchen benches, Bosch appliances, an outdoor spa, triple garage and a glorious master retreat which could make this property a luxury investment for buyers,”

“While a range of factors will come into play which will ultimately decide which property will achieve the highest price from buyers, the additional cash flow depreciation provides astute buyers is important to consider when crunching the numbers to make purchase decisions,”

“While Hannah and Clint appear to be the clear winners in terms of unlocked depreciation value - it’s a very close field,” said Bradley Beer.

Following is a summary of the depreciation estimates BMT Tax Depreciation found for all five properties.

The Block’s production company paid $10.34 million for the site the properties are located on earlier this year. Each of the houses were former wrecks rescued for the television show and driven to the site for renovation.

It is expected that each property will fetch in excess of $2.4 million at the auction schedule this Saturday.

Lauren Howarth

0448 507 979 | lauren.howarth@bmtqs.com.au

BMT Tax Depreciation